SBI Fund Management Ltd.’s Share Price and NAV Performance | Latest Update New Delhi

- Location: Delhi, New Delhi, Delhi, India

Follow the SBI Fund Management Ltd share price and NAV to make smart investments. SBI Fund Management unlisted share buyers can view current price trends, valuation data, and pre-IPO prospects. SBI Fund Management, one of India's largest mutual fund businesses, has high growth potential due to its reputation, performance, and AUM. Keep up with SBI Fund Management Limited's IPO, stock, and long-term investing prospects. Compare past performance, risk factors, and predicted returns before buying this popular unlisted mutual fund stock.

Useful information

- Avoid scams by acting locally or paying with PayPal

- Never pay with Western Union, Moneygram or other anonymous payment services

- Don't buy or sell outside of your country. Don't accept cashier cheques from outside your country

- This site is never involved in any transaction, and does not handle payments, shipping, guarantee transactions, provide escrow services, or offer "buyer protection" or "seller certification"

Related listings

-

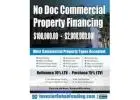

NO DOC COMMERCIAL & MULTIFAMILY Property Financing To$2,000,000.00!Financial Services - Waimalu (Hawaii) - February 24, 2026

NO DOC COMMERCIAL & MULTIFAMILY Property Financing To$2,000,000.00!Financial Services - Waimalu (Hawaii) - February 24, 2026NO DOC COMMERCIAL/MULTIFAMILY PROPERTY FINANCING Up To $2,000,000.00.No Tax Returns and No Bank Statements. 5 Year ARM Or 30 Year Fixed Rate. 700 Minimum Credit Score. MOST PROPERTY TYPES QUALIFY: Multifamily 5+ Units, Mixed Use, Retail Sp...

-

Reliable Internal Audit Services by Audit ConsultantFinancial Services - Noida (Uttar Pradesh) - February 24, 2026

Reliable Internal Audit Services by Audit ConsultantFinancial Services - Noida (Uttar Pradesh) - February 24, 2026Enhance accountability with structured Internal Audit Services led by a skilled Internal Audit Consultant. We evaluate financial reporting processes, review operational controls, assess regulatory compliance, and provide practical solutions to improv...

-

Top Forensic Audit Firms Delivering Audit ServicesFinancial Services - Noida (Uttar Pradesh) - February 24, 2026

Top Forensic Audit Firms Delivering Audit ServicesFinancial Services - Noida (Uttar Pradesh) - February 24, 2026Engage leading Forensic Audit Firms for advanced Forensic Audit Services that safeguard your organization against financial risks. We perform fraud investigations, compliance reviews, asset verification, forensic accounting analysis, and expert repor...